8 Common Estate Administration Mistakes

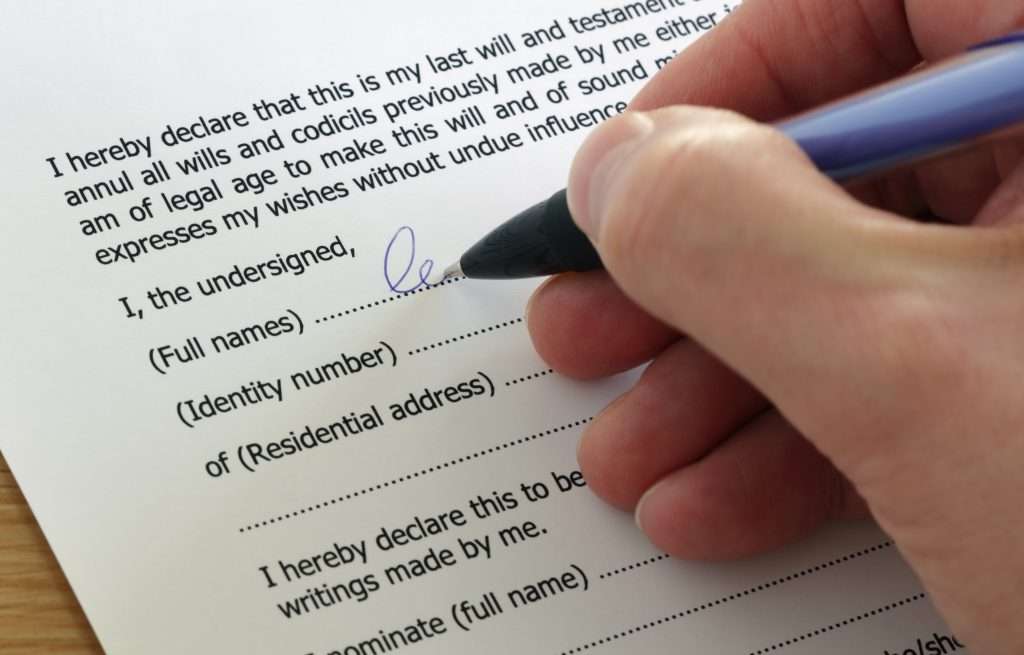

Estate Administration – that is, handling someone’s financial and legal affairs when they pass away – is not an easy task, especially if you don’t have any experience. Even a relatively simple estate requires a lot of paperwork and can involve everything from valuing assets and selling the property to keeping detailed accounts and dealing with taxes. The most important point to note is that whatever duties you carry out, they must all be done with the utmost accuracy. Errors in administering an estate could have serious legal and financial implications. Some of the most common Estate Administration mistakes are:

- Not applying for Probate in good time

Without making an application for Probate (should the estate require it) an Executor won’t have the legal authority to deal with the person’s financial affairs. While there isn’t a statutory time limit on applying for Probate itself, many people don’t realise that there is a six-month time limit for the payment of Inheritance Tax. So, if the estate is subject to Inheritance Tax, a tardy Executor could incur financial penalties from the HMRC.

- Not understanding the terms of the Will

Legal jargon, codicils (amendments to the Will), unclear instructions and discrepancies between what the Will says and what the deceased may have told relatives can all create confusion. If there’s any ambiguity, it may lead to errors in distributing the estate correctly and perhaps prompt a costly inheritance dispute. It’s advisable for novice Executors and Administrators who are unclear about the terms of a Will to seek professional guidance.

- Spelling mistakes

Minor discrepancies may cause nothing more than an annoying delay in the paperwork, but spelling someone’s name wrong on forms could be more problematic. Someone’s known name may not actually be the legal name on their birth certificate. So, make sure you have all the correct information (including middle or maiden names) and that your paperwork is consistent with the person’s official documentation.

- Not keeping accurate records and accounts

Everything an Executor or Administrator does should be recorded in writing. If something can’t be accounted for, as the Personal Representative they may be liable. A common error is failing to keep accurate lists of possessions or record which assets have been distributed to whom.Clear and accurate accounting is vital, but many people aren’t as stringent as they should be in this regard. Every single valuation, calculation and transaction as regards the estate itself, and any costs the Executor or Administrator incurs as part of their role, must be documented. If a beneficiary should contest the estate, these records will be extremely important.

- Incorrect valuation of assets and miscalculation of taxes

Relying on your best guess when valuing assets or calculating taxes due just won’t cut it. Personal Representatives must be very careful that any valuation or tax information is as accurate as possible. Inheritance Tax is a complex area of law and something that many people struggle to get right. If you’re confused by tax forms or don’t have the capacity to carry out accurate valuations, you need to get professional advice. Any mistake that has tax implications could land you in serious trouble with HMRC.

- Missing out assets

Not identifying or collecting the entirety of the deceased’s assets is a relatively common error. In some cases, an Executor may not have done enough research to track assets down. In others, they may consider a very minor asset – like a low balance account – to be not worth worrying about. However, the Personal Representative can be held liable for any omissions.

- Failing to identify and pay off debts

Most people like to keep their debts quiet, so it’s not surprising that an Executor may sometimes fail to realise there is money owed from the estate. It’s essential to be extremely thorough in checking for debts. Any outstanding liabilities and creditors must be identified so that any debts can be paid or written off before the estate is distributed to beneficiaries.

- Distributing assets too soon

Pressure from beneficiaries and a desire to wrap up the estate promptly can often result in assets being released too early. It’s wise for Personal Representatives to hold off on distributing the estate until they are sure they have a full understanding of all the assets and liabilities. If property, money or other assets are distributed before then, it’s a lot harder to account for everything.

Using a Professional Executorship Service

The workload and potential for getting things wrong with Estate Administration are reasons why many people turn to a Professional Executor for help. As Probate and administration experts, a Professional Executor is able to complete the necessary tasks correctly and expediently, so you don’t have to worry about making mistakes, incurring liability or the general stress of it all.

Laurelo’s Professional Executorship Service is a ‘one-stop-shop’ designed to help ease the burden on your family when the time comes. We’ll take care of all the complex administration, so your loved ones don’t have to deal with any unnecessary hardships at an already difficult time.

If you would like us to act as Executors on your behalf after you pass or want to know more about our Professional Executorship Service, please get in touch for a chat with our specialist Probate team today.

This article is intended to provide information only and does not constitute legal advice. We do not accept any responsibility for any omission or loss as a result of this article.

Recent Posts

19 February 2026

Can You Die Of A Broken Heart?

Read More

19 February 2026

How To Spot An Original Will

Read More

19 February 2026

Paul Radcliffe on Dying for a Cuppa® – A Candid Conversation About Death, Support and Probate

Read More

10 February 2026

Putting Families First In Probate, Not Awards

Read More

6 January 2026

Laurelo Celebrates Four Years of Outstanding Service from Lead Consultant Paul Radcliffe

Read More

19 December 2025

A Milestone That Means the World: 100 Google Reviews for Laurelo!!!

Read More