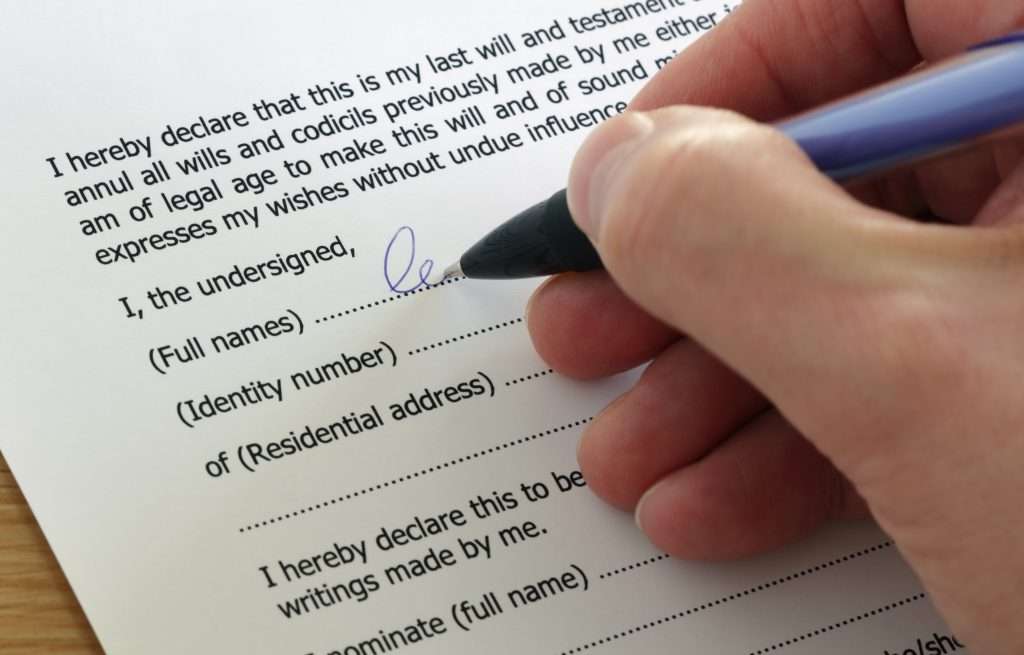

Inheritance Tax in the UK: Myths and Reality

Inheritance Tax (IHT) is a tax imposed on the transfer of assets from one person to another, either upon death or as a gift. In the UK, IHT is applicable on estates valued above £325,000 and is charged at a rate of 40%. The subject of IHT is often shrouded in myths, so in this blog post, we will attempt to dispel some of these myths and provide a clearer understanding of the reality of IHT.

Myth 1: IHT only affects the wealthy

While it is true that the wealthy are often the ones who pay the most IHT, this tax can affect anyone who has assets worth more than £325,000. This threshold has remained the same since 2009, and with the rising cost of living and house prices, it is becoming increasingly common for more people to fall within the IHT bracket.

Myth 2: IHT only applies to property

IHT applies to all assets, not just property. This includes savings, stocks, shares, and personal possessions such as jewellery and artwork.

Myth 3: IHT cannot be avoided

While there is no way to entirely avoid IHT, there are several ways to minimise it. For example, gifts made more than seven years before death are exempt from IHT, and annual exemptions can be claimed for gifts up to £3,000 per year. There are also other reliefs and exemptions available.

To find out more about IHT or to be recommended to one of our Financial experts (in your area) please contact us by emailing info@laurelo.co.uk

Recent Posts

19 February 2026

Can You Die Of A Broken Heart?

Read More

19 February 2026

How To Spot An Original Will

Read More

19 February 2026

Paul Radcliffe on Dying for a Cuppa® – A Candid Conversation About Death, Support and Probate

Read More

10 February 2026

Putting Families First In Probate, Not Awards

Read More

6 January 2026

Laurelo Celebrates Four Years of Outstanding Service from Lead Consultant Paul Radcliffe

Read More

19 December 2025

A Milestone That Means the World: 100 Google Reviews for Laurelo!!!

Read More