Understanding the Risks of Being an Executor

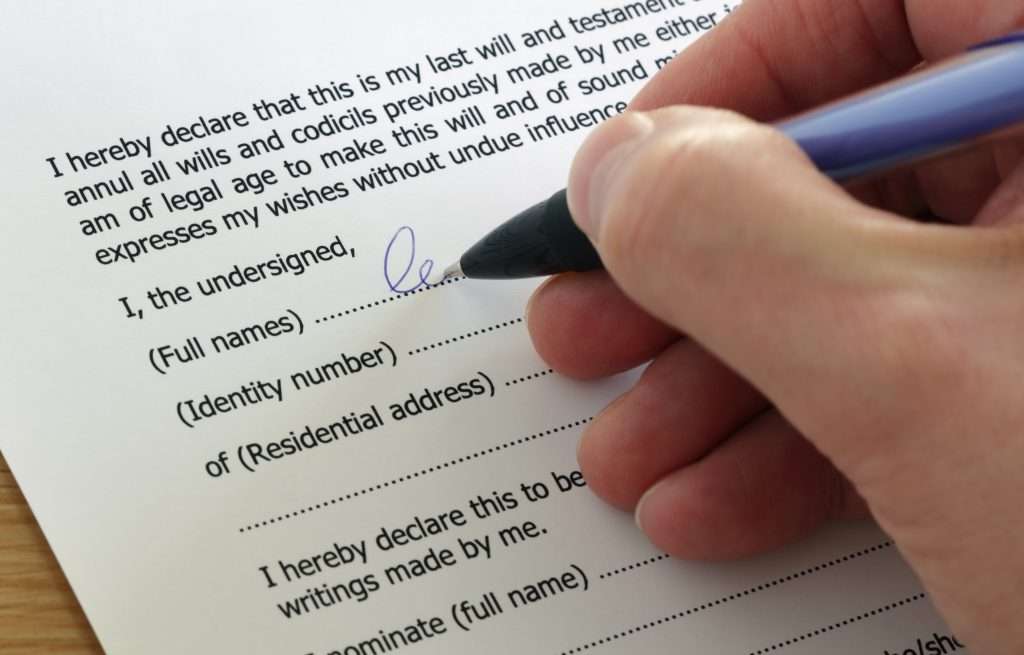

Being asked to be the Executor of a Will is something many of us consider to be quite an honour. While it’s flattering that someone trusts you enough to leave their affairs in your hands, a lot of people don’t truly understand what the role actually entails. It’s only when you’re up to your elbows in paperwork and accounts, wondering how on earth you’re supposed to make sense of all the Inheritance Tax rules, that reality bites. It’s important to understand that there are major responsibilities and risks in being an Executor – even an innocent mistake could have legal and financial implications.

What liabilities do Executors face?

Many people don’t realise that Executors can be held legally and financially liable for mistakes made during the Estate Administration process. Examples include:

- Incorrect tax calculations: valuing all the assets of the estate correctly is a crucial part of Estate Administration. Executors need to ensure that they do not under-declare the tax liability. While HMRC do differentiate between innocent mistakes and deliberate or concealed actions in calculating tax owed by the estate, there are serious financial penalties for any errors for which the Executor can be held personally liable. Inheritance Tax can often run into tens of thousands of pounds and is penalised by HMRC on a percentage basis, so it could get very expensive indeed.

- Not settling outstanding debts: it’s extremely important for anyone handling an estate to identify and pay off any outstanding debts before the estate is distributed. If any creditors were to subsequently come out of the woodwork, the Executor would be personally liable up to the value of the estate. Also, in the case of insolvency, there are strict rules governing the settlement of creditors – ignore them at your peril.

- Failing to manage assets appropriately: underselling a property, losing assets, failing to maintain adequate insurance where necessary, distributing assets too early – there are many mistakes that you may inadvertently make which could result in you facing legal action. Distributing assets too early is a common issue that can be problematic, not just in terms of creditors, but also because there may be beneficiaries who subsequently make a claim. So, proceed with caution.

- Taking sides in a dispute: this can get particularly tricky when Executors are also beneficiaries (which is often the case) as there may be a conflict of interest. As an Executor your remit is to act in the best interest of the estate, so you need to remain a neutral party in any dispute. Failure to do so could see you facing legal action and court costs. In this scenario, it’s wise to stop the administration process and seek professional advice.

- Failing to keep accurate expenses: an Executor can claim reasonable expenses for ‘proper estate business’ but keeping accurate records and receipts is vital. Transparency is key and will help you defend yourself if you find yourself challenged by beneficiaries over your Executor expenses.

What can I do if I no longer want the responsibility of being an Executor?

If you’re a named Executor in the Will of the deceased but decide you can no longer undertake the role, you can renounce your Executorship. You need to do this before you start executing any responsibilities relating to the estate. If there is more than one Executor, the remaining Executor/s can continue with the Probate process.

Or you may want to instruct a Professional Executor to take on responsibility for administering the estate. Obviously, there are costs involved in this option, but they are often more than offset by the stress relief of not having to handle things yourself. Each case is different, so you need to decide what works best for you.

Professional Executorship services from Laurelo

We understand that being an Executor isn’t for everyone. While you may have promised a loved one that you would personally take care of everything on their death, circumstances can change. If you don’t feel you have the ability to take on the role of Executor, we can help.

At Laurelo, we offer Professional Executorship Services that give you peace of mind. Your Personal Estate Manager will take care of every step while keeping you in the loop, so you don’t have to worry about the responsibility or risks of administering the estate.

If you’d like to book your free consultation or just want to know more about our services, we’re always happy to advise. Just email us at info@laurelo.co.uk or give us a call on 0203 058 2329.

This article is intended to provide information only and does not constitute legal advice. We do not accept any responsibility for any omission or loss as a result of this article.

Recent Posts

19 February 2026

Can You Die Of A Broken Heart?

Read More

19 February 2026

How To Spot An Original Will

Read More

19 February 2026

Paul Radcliffe on Dying for a Cuppa® – A Candid Conversation About Death, Support and Probate

Read More

10 February 2026

Putting Families First In Probate, Not Awards

Read More

6 January 2026

Laurelo Celebrates Four Years of Outstanding Service from Lead Consultant Paul Radcliffe

Read More

19 December 2025

A Milestone That Means the World: 100 Google Reviews for Laurelo!!!

Read More