What are the Consequences of Dying Without a Will?

No one likes to think about their own about death. It’s one reason why over half of adults in the UK haven’t made a Will yet. But have you ever considered what would happen to your assets if you should pass away before you’re able to make your final wishes a formality? There are plenty of widely held misconceptions about who would have inheritance rights under the law which often result in legal and financial stresses for the bereaved. So, if you’re not sure what might happen, here are some of the consequences of dying without a Will.

The Rules of Intestacy

‘Dying intestate’ is the term used to describe passing away without leaving a Will. The estate of someone who has died intestate is dealt with under the ‘Rules of Intestacy’, as set out in the Administration of Estates Act 1925. These are the regulations that establish who is entitled to inherit assets where no Will exists. The rules are quite complex but in simple terms, the order of inheritance is:

If the person was married or in a civil partnership:

- If there is a surviving spouse or civil partner but no children: the spouse is entitled to the entirety of the estate.

- If there is a surviving spouse or civil partner and children: the spouse inherits the personal possessions and all assets including property up to the value of £270,000. The residuary estate is then divided equally – 50% to the spouse and the other 50% to any surviving children.

Where there is no surviving spouse or civil partner, but the deceased has children:

- Both biological and adopted children are entitled to inherit the estate (but not stepchildren).

Where there are no children:

- The parents of the deceased inherit equal shares if both survive, or the surviving parent inherits the entire estate.

Where there are no surviving parents:

- Full blood siblings are next in line to inherit. If they have already passed away, their entitlement passes to their children should they have any.

Where there are no surviving full siblings:

- Half siblings may inherit.

Next in line are grandparents, aunts and uncles and half aunts and uncles. If no relatives can be traced, the estate will be passed to the Crown.

Dying intestate and cohabitation

It’s important to understand that the way your estate would be distributed under the Rules of Intestacy. As the above list shows, it may contrast wildly with what you actually want to happen.

One of the most commonly held misunderstandings about inheritance is that a cohabiting partner has automatic inheritance rights under the law. In fact, they do not. Many bereaved ‘common law’ partners are shocked when they find themselves in financial difficulty or without a home as a result. If they can prove they were financially dependent on the deceased, they may be able to make a claim for reasonable financial provision under the Inheritance (Provision for Family and Dependants) Act 1975. However, this can cause unnecessary stress and worry at a time when they are also grieving.

How to protect your family and your legacy

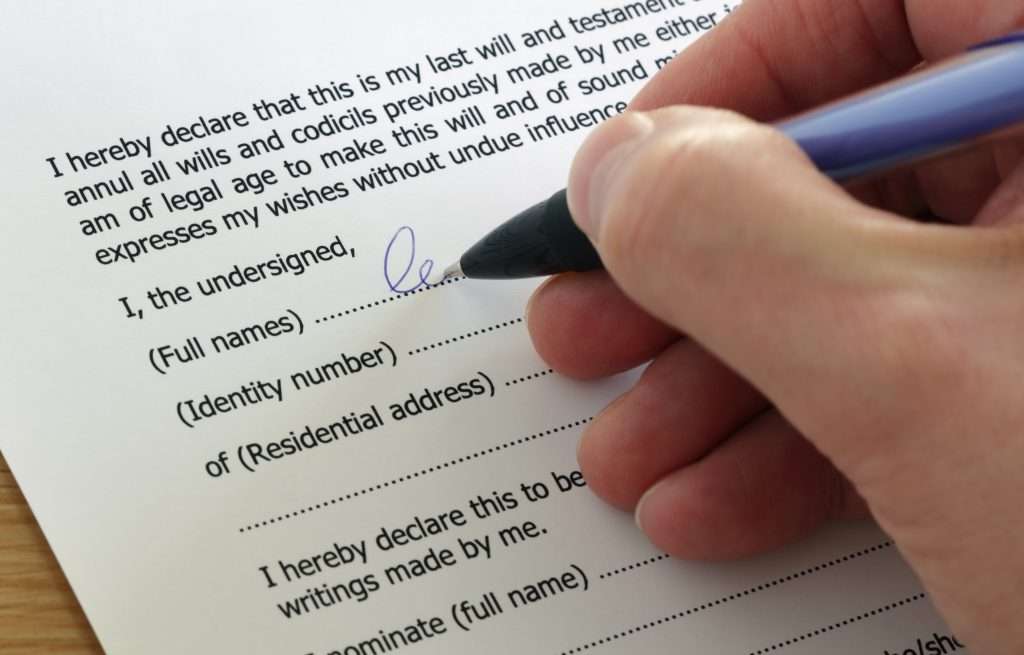

The best way to ensure your loved ones are protected for the future is to make a Will. Otherwise, your assets could end up where you don’t want them to. When making a Will it’s really important to ensure it’s been properly drafted and stored in a very safe place. If you don’t, you could end up right back at square one as, in the event that a Will cannot be found or is deemed invalid for any reason, the law equates this to dying intestate. Therefore, your estate will be distributed according to intestacy rules despite all your efforts.

If you’d like to know more about how we can help you with secure Will storage, Probate applications, Professional Executorship or Full Estate Administration services, contact our Laurelo Probate and Estate Administration specialists on 0203 058 2329.

This article is intended to provide information only and does not constitute legal advice. We do not accept any responsibility for any omission or loss as a result of this article.

Recent Posts

19 February 2026

Can You Die Of A Broken Heart?

Read More

19 February 2026

How To Spot An Original Will

Read More

19 February 2026

Paul Radcliffe on Dying for a Cuppa® – A Candid Conversation About Death, Support and Probate

Read More

10 February 2026

Putting Families First In Probate, Not Awards

Read More

6 January 2026

Laurelo Celebrates Four Years of Outstanding Service from Lead Consultant Paul Radcliffe

Read More

19 December 2025

A Milestone That Means the World: 100 Google Reviews for Laurelo!!!

Read More