Here’s a step-by-step guide for individuals who don’t have any personal experience when someone dies in the UK and when probate comes into play:

1. Register the Death: The first step is to register the death at the Registrar of Births and Deaths. This is essential to obtain death certificates. Alongside this, complete the “Tell Us Once” service, which helps notify various government departments of the passing. It can be an emotional moment; take your time. Remember, they are there to assist.

2. Funeral Arrangements: Plan the funeral by contacting a local funeral director, we recommend using a member of SAIF (society of Allied Independent Funeral Directors). Check if the deceased had a pre-paid funeral plan in place. The funeral director will guide you through the arrangements. Plan the funeral with the support of friends or family. Share the responsibilities to alleviate the emotional burden. Consider involving close friends who knew the deceased well to help you make meaningful choices.

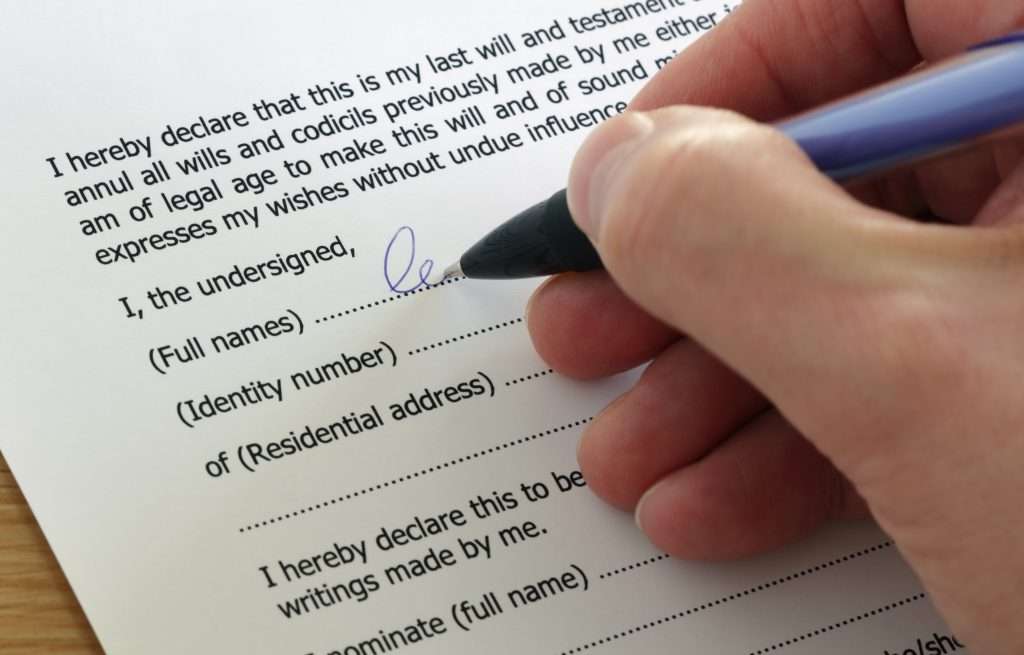

3. Will Examination: Locate the deceased’s will. If you find one, check if it contains any specific funeral wishes. If you’re not appointed as the executor in the will, contact the executors named in the document. Laurelo can help with this.

4. Will Validation: Validate the will to ensure it’s the last will and testament of the deceased. Additionally, check with the probate registrar for any linked accounts and perform a search in the Will database. Where possible show understanding towards the executors and those named/not named in the will. Laurelo can help with this.

5. Securing Assets and Documents: If the deceased’s home is unoccupied, take steps to secure it, along with valuables and important documents. Check if there’s insurance coverage for the house and its contents and notify the insurers. Arrange a redirection of post to ensure important mail reaches you. Try where possible to treat their space with the same care they would. If possible, involve friends or family in this process. Laurelo can help with this.

6. Car Insurance and Utilities: Notify the deceased’s utility providers and their car insurers to avoid complications with coverage. When speaking to customer service representatives remember they should be accommodating. Laurelo can help with this.

7. Gathering Documents: Collect personal documents belonging to the deceased. Create a list of their assets and liabilities. If you can, check if the deceased made any lifetime gifts of cash or other assets and document these. Laurelo can help with this.

8. Financial Checks: Run bankruptcy checks, insolvency checks, and dormant asset searches to ensure there are no hidden financial complications. When running financial checks, remember that some debts may be sensitive. Handle these matters with empathy and consider involving a financial advisor to navigate complex issues. Laurelo can help with these.

9. Government Notifications: Notify HMRC (Her Majesty’s Revenue and Customs) and take necessary actions as per their guidelines. Also, inform the DWP (Department for Work and Pensions) and allocate a case manager if required. Laurelo can help with this.

10. Bank and Financial Institutions: Register the death certificate with the various financial institutions where the deceased held accounts or investments. When registering the death with financial institutions, you can enquire about available bereavement support services. But remember many banks outsource this work to commission paying companies so be sure whoever you use is the right fit for you/your circumstances. Laurelo can help with this.

11. Funeral Expenses: Arrange to pay for the funeral expenses from the deceased’s assets or funds specifically set aside for this purpose. If you’re concerned about covering funeral expenses, reach out to organisations that may offer financial assistance or flexible payment options. Laurelo can help here.

12. Inheritance Tax: Within one year of the death, complete the Inland Revenue Account form, either an IHT400 or an IHT205, detailing all estate assets, debts, and expenses. Pay any inheritance tax due to HMRC and obtain a receipt. Seek guidance from a probate specialist like Laurelo for inheritance tax matters. Their expertise can alleviate a lot of unnecessary stress. Laurelo can help with this.

13. Beneficiary Accounting: Prepare accounts to account to the beneficiaries under the will or those inheriting on intestacy. Calculate their entitlements and seek their approval for the accounts. If necessary, trace and identify beneficiaries. Laurelo can help with this.

14. Final Steps: Review and confirm all financial details, ensuring that allowances have been applied and all data is accurate. Laurelo can help with this.

15. Grant of Probate: If required, apply for a Grant of Probate following the strict guidelines on documentation. Laurelo can help with this.

After Obtaining the Grant of Probate:

1. Financial Institution Communication: Register the grant with various financial institutions, collect estate assets, and pay any outstanding debts and administration expenses. Laurelo can help with this.

2. Creditor Notices: Decide whether to place notices to creditors to protect the executor from potential disclosed debts. Monitor for any claims against the estate during the specified period. Laurelo can help with this.

3. Asset Management: Make decisions on encashing assets or transferring them to beneficiaries. Collect bank account balances, sell or transfer stocks and shares, and encash policies. Decide whether to sell the house or transfer it to beneficiaries. Laurelo can help with this.

4. Audit Questions: Address any audit questions, which can be unique to each application and may require further work. Laurelo can help with this.

5. Closure and Distribution: Oversee the closure of the estate and the distribution of assets to beneficiaries, ensuring a smooth and efficient process. Laurelo can help with this.

Remember, this can be a complex and emotional journey, and professional assistance, like the services provided by Laurelo, can offer invaluable support in navigating most of this process with care and expertise.

There are some other steps you should take to look after yourself and your emotional wellbeing:

Seek Emotional Support: It’s essential to express your emotions during this challenging time. Lean on friends, family, or support groups to share your feelings.

Take Breaks: Don’t forget to take breaks. Grieving can be exhausting. Find moments for self-care and relaxation.

Prioritise Mental Health: Remember that your mental well-being is crucial. Consider seeking professional help from grief counsellors or therapists if needed.

Memorialise with Love: Create a loving memorial or tribute to celebrate the life of the deceased. This can be a source of comfort and closure.

Empathy in Closure:

Support for Beneficiaries: When presenting the accounts to beneficiaries, do so with empathy. Understand that this process may evoke various emotions in them.

Consider Beneficiaries: Keep beneficiaries informed about the progress and timelines. Their understanding and cooperation are essential during this phase.

Final Farewell with Compassion: The closure of the estate is a poignant moment. Handle it with the same care and compassion you showed throughout the process.

Remember, this journey can be challenging, but with empathy, self-care, and the support of professionals, you can navigate it with grace and compassion. Services like Laurelo are here to provide expertise and a caring hand throughout this difficult time.

Recent Posts

19 February 2026

Can You Die Of A Broken Heart?

Read More

19 February 2026

How To Spot An Original Will

Read More

19 February 2026

Paul Radcliffe on Dying for a Cuppa® – A Candid Conversation About Death, Support and Probate

Read More

10 February 2026

Putting Families First In Probate, Not Awards

Read More

6 January 2026

Laurelo Celebrates Four Years of Outstanding Service from Lead Consultant Paul Radcliffe

Read More

19 December 2025

A Milestone That Means the World: 100 Google Reviews for Laurelo!!!

Read More