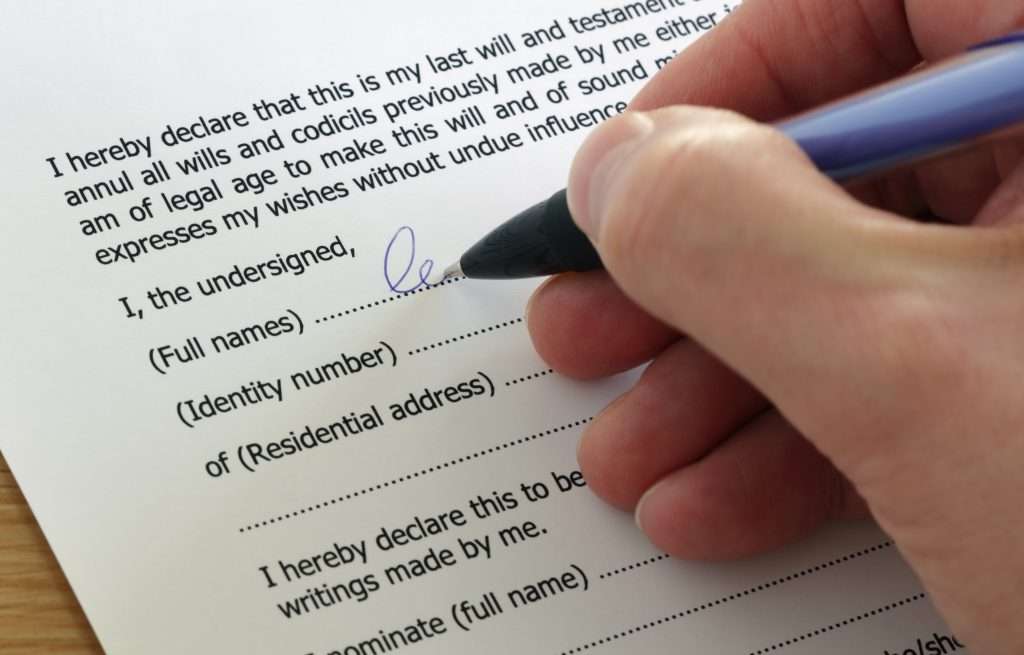

Writing Your Will? Avoid These Common Mistakes

While solicitors and professional Will writers have seen a huge increase in Will enquiries since the start of the Coronavirus pandemic, millions of people in the UK have not yet made a Will. Unfortunately, even those who do take the time to set out their wishes must be careful to avoid a few common mistakes. The law surrounding Wills is relatively complex, which means that it is easy to make a mistake without even realising. A simple error in your Will could result in a family inheritance dispute, the unintended disinheritance of a loved one or may even invalidate the entire document.

Common Will writing errors

- You don’t get the Will witnessed properly.

There are strict rules when it comes to who can be a witness and how it should be done. If a Will is not witnessed correctly it may be deemed invalid. Firstly, whomever you choose as a witness cannot be a beneficiary or the spouse of a beneficiary. Asking someone who you want to inherit your assets to be your witness could see them disinherited. Secondly, you need two witnesses who must both be physically present when signing the will, both be over the age of 18 and have UK citizenship.With social distancing making the witnessing of Wills somewhat problematic over the last year, there have been some creative approaches to the process (however, there are fears that some people may find their Wills invalidated further down the line). To address the issue, an amendment has been made to the Wills Act 1837 to allow the live-link video witnessing of Wills until Jan 2022. (Read the Law Society’s guidance here.) - You fail to include all your assets.

Most people remember to bequeath the house, the car and the jewellery, but it’s wise to document as many of your assets as you can. Go through your paperwork and track down all those unused bank accounts, old premium bonds or shares you may have tucked away and forgotten about. In addition to your assets, don’t forget to subtract any debts you may have.

Many people also forget about their digital assets. These may be financial, like bitcoin, or could be your online and social media accounts or digital photo albums. They might not be physical assets, but they all belong to you, so you need to make sure your Executor knows about them. - You don’t appoint an Executor.

You need to nominate a responsible person to take care of all the administration that is involved in sorting out your estate after death. If you don’t choose someone for the job, the courts will do that for you, which could lead to problems or disputes between family members. - You choose the wrong Executor.

If you do remember to appoint an Executor, make sure you choose the right people or person for the role. Handling someone’s affairs after death, known as Estate Administration, can be quite a stressful and complex process. Whomever you choose for the role needs to be someone capable of dealing with the task, both practically and emotionally.

If you’re worried about assigning the responsibilities to a friend or relative, it’s worth considering appointing a full Estate Administration Service. Using a professional can ease the burden on your family and speed up the entire process. - You don’t keep your Will up to date.

Many people make the mistake of failing to update a Will when their life circumstances change. Buying a home, marriage, divorce, death, adding stepchildren to the family – they’re all events that may necessitate the amendment of your Will. If you don’t make sure it’s up to date, your family may not be protected in the way you want them to be. This needs to be done properly (a scrawled note in the margins won’t cut it) so it’s best to consult a Will writing expert to add a codicil (amendment) or to redo the document altogether. - You don’t keep the original copy of your Will safe.

The original copy will be needed for any Probate application. Not having the original Will could also lead to a legal dispute, so it’s important to store it safely. While many people store their Wills at home, this can be risky. There’s potential for loss, theft or fire and flood damage. It’s a lot safer to have a professional will storage service to take care of things, so you don’t have to worry. - You make a DIY Will.

If you’re not familiar with the law, making a DIY Will can be risky, especially if you own property or have a more complex estate. If you want to ensure that everything is done correctly, it’s better to seek the guidance of a Will writing professional. Although Will writing is not regulated in England and Wales, it’s a good idea to choose a solicitor or Will writer who is regulated by the Society of Trust and Estate Practitioners (STEP) or the Institute of Professional Willwriters (IPW).

Our Probate experts

At Laurelo, we do all we can to help make life easier for you and your family. From Will storage solutions and Probate Applications to Professional Executorship and Full Estate Administration Services, we’re here to guide you through life’s most difficult moments.

To speak to our compassionate and experienced experts, call us on 0203 058 2329 or email info@laurelo.co.uk.

This article is intended to provide information only and does not constitute legal advice. We do not accept any responsibility for any omission or loss as a result of this article.

Recent Posts

19 February 2026

Can You Die Of A Broken Heart?

Read More

19 February 2026

How To Spot An Original Will

Read More

19 February 2026

Paul Radcliffe on Dying for a Cuppa® – A Candid Conversation About Death, Support and Probate

Read More

10 February 2026

Putting Families First In Probate, Not Awards

Read More

6 January 2026

Laurelo Celebrates Four Years of Outstanding Service from Lead Consultant Paul Radcliffe

Read More

19 December 2025

A Milestone That Means the World: 100 Google Reviews for Laurelo!!!

Read More